1. Introduction: From Code to Cash?

In a world where milliseconds can mean millions, the ability to predict market movements has become a high-stakes game. For decades, professional traders relied on fundamental analysis, technical charts, and gut instinct. But in recent years, artificial intelligence (AI) has quietly — and rapidly — changed the rules.

From hedge funds deploying algorithmic trading bots to retail investors using AI-powered stock screeners, the question is no longer if AI can help with investing, but how effectively it can do it. Some claim that smart machines can now “read” the market — analyzing massive amounts of financial data, headlines, and social sentiment in real time to generate predictive insights that humans simply can’t match.

So, how exactly does AI pull this off? What kind of technology powers these predictions? And just how reliable is it?

In this article, we’ll peel back the layers of modern financial AI — explaining how it works, what data it relies on, and where its limits lie. We’ll explore how machine learning models are being trained to recognize patterns in stock price movements, how natural language processing (NLP) helps interpret news headlines and tweets, and how these insights are being used by institutions and everyday traders alike.

While AI might not offer a guaranteed path from code to cash, it’s certainly reshaping the way we understand — and interact with — financial markets.

2. What Does It Mean to ‘Read’ the Market?

To understand how AI “reads” the market, we need to first understand what market reading means in a human context. Traditionally, reading the stock market involves analyzing signals that might indicate where prices are heading. This could be technical patterns, company fundamentals, macroeconomic indicators, or even public sentiment.

For humans, these tasks require time, knowledge, and intuition. But for AI, it’s all about processing massive datasets at high speed, spotting correlations that may not be obvious to the human eye.

“Reading the market” using AI doesn’t mean predicting the exact future — it means identifying statistical patterns and signals that suggest a probable direction or behavior of an asset. These predictions are based on historical data, real-time news feeds, financial statements, social media sentiment, and more.

For example, a machine learning model might detect that when a particular sector (e.g., semiconductors) experiences rising volume combined with positive earnings sentiment, there’s a historically increased probability of short-term price appreciation. While this doesn’t guarantee future results, it can provide probabilistic forecasts that help guide decision-making.

The AI’s ability to analyze and synthesize data across multiple sources — in seconds — gives it an edge. Where a human might skim a few articles and charts, an AI can parse thousands of data points per second, from global financial markets to Reddit threads.

In short, AI “reads” the market not through intuition, but through data-driven pattern recognition, giving it a unique way of seeing opportunities before they become obvious to the crowd.

3. The Tech Behind It: How AI Makes Sense of Market Chaos

Financial markets are noisy, volatile, and full of conflicting signals. For decades, analysts have used models based on economics, statistics, and technical indicators to make sense of this chaos. But with the rise of machine learning (ML), a new approach has emerged — one that doesn’t rely on hardcoded rules or assumptions, but instead learns from data.

At the core of AI-based market prediction are three major types of machine learning:

1. Supervised Learning

This is the most commonly used technique in financial prediction. In supervised learning, algorithms are trained on historical input-output pairs — for example, past stock prices and the direction they moved. The model learns to map input features (like price momentum, volume, or sentiment) to a specific output (e.g., price going up or down tomorrow).

Popular models include linear regression, decision trees, and deep neural networks.

Use case: Predicting whether a stock will go up or down the next day based on current technical and news indicators.

2. Unsupervised Learning

Here, the algorithm isn’t told what to predict — instead, it looks for hidden patterns or clusters in the data. This is useful in segmenting stocks based on behavior, volatility, or correlation.

Use case: Grouping stocks into categories that behave similarly (e.g., tech growth vs. dividend value), helping build diversified portfolios or identify outliers.

3. Reinforcement Learning (RL)

Inspired by how humans learn from experience, RL involves an “agent” that learns by interacting with the market — buying, selling, holding — and receiving rewards (e.g., profit) or penalties (e.g., loss). Over time, the agent improves its strategy to maximize long-term gains.

Use case: Building autonomous trading bots that adapt their strategies based on evolving market conditions.

These techniques allow AI not just to observe the market, but to learn its patterns, continuously adapting as new data flows in. Unlike traditional models that often break when market conditions change, machine learning systems can re-train and evolve — making them especially powerful in fast-moving environments.

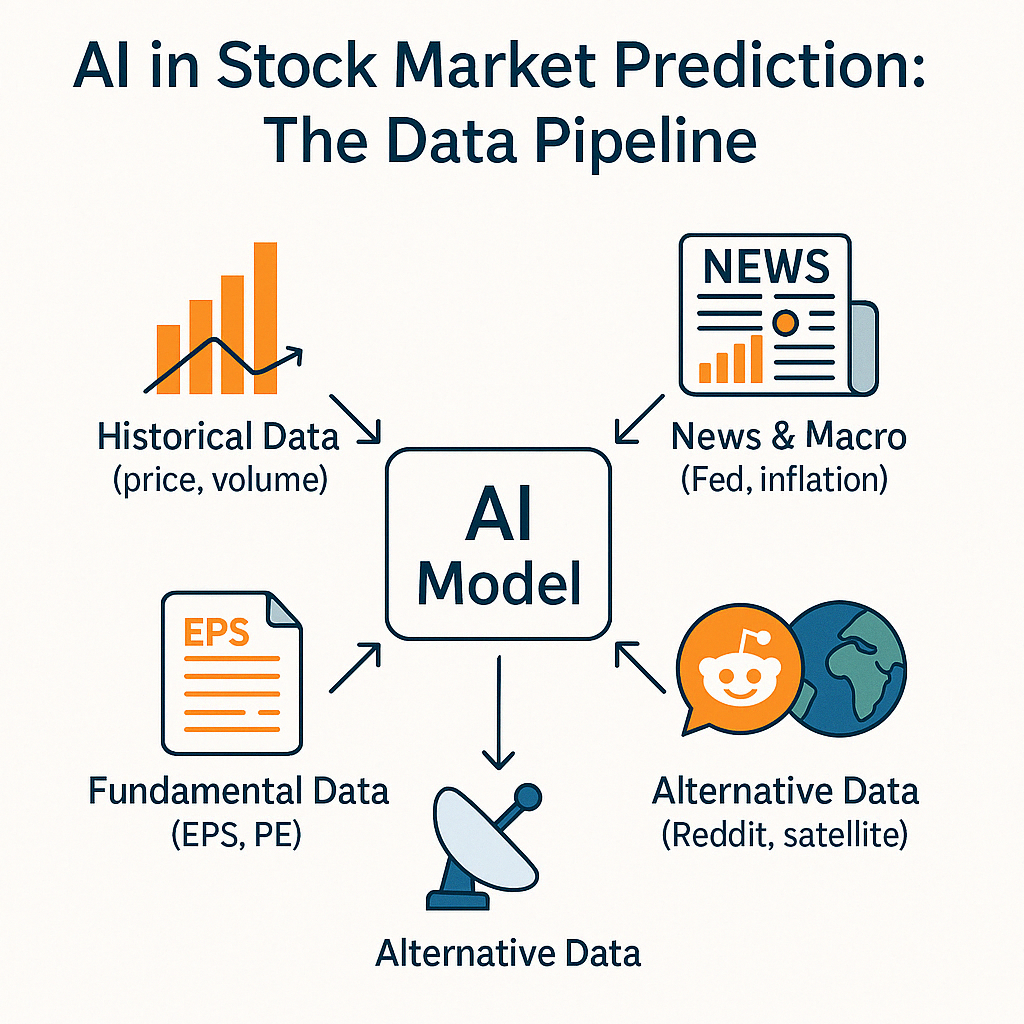

4. Data Is the New Oil: What AI Models Feed On

Artificial intelligence thrives on data — and in the world of financial markets, data is both abundant and chaotic. The quality and diversity of data fed into an AI model directly affect its predictive power. As the saying goes, “garbage in, garbage out.”

Here are the main categories of data that AI models rely on to “read” the market:

1. Historical Market Data

Price charts, trading volume, open interest, bid-ask spreads — these traditional data points form the backbone of most models. Historical data helps AI identify technical patterns such as momentum, mean reversion, or breakout signals.

2. Fundamental Data

AI models can also ingest financial statements, earnings reports, balance sheets, and valuation ratios (like P/E or P/B). This helps assess a company’s intrinsic value or detect long-term trends.

3. News and Economic Indicators

Using natural language processing (NLP), AI can analyze global news headlines, central bank announcements, employment figures, and inflation data. These are critical for anticipating macroeconomic shocks or investor sentiment shifts.

Example: A model might detect that hawkish language from the Federal Reserve often correlates with short-term declines in tech stocks.

4. Alternative Data

This is where things get interesting. AI also taps into unconventional sources such as:

- Social media posts (e.g., Reddit, Twitter)

- Satellite imagery (e.g., counting cars in retail parking lots)

- Web traffic or credit card transaction data

These datasets offer unique insights that aren’t always reflected in traditional reports — and they’re often faster.

In short, data is the fuel that powers AI’s decision engine. The broader and timelier the dataset, the more likely the model can detect early signals and subtle correlations before they become obvious to human investors. The best-performing AI systems today don’t rely on just one source — they combine multiple streams to create a comprehensive view of the market.

5. Real-World Use Cases of AI in Finance

AI is no longer a theoretical concept in the world of finance — it’s already at work, powering decision-making systems across hedge funds, investment platforms, and fintech startups. Below are some notable real-world applications where AI has made a measurable impact:

1. Renaissance Technologies – Quant Powerhouse

Often regarded as the most successful hedge fund in history, Renaissance Technologies relies heavily on complex mathematical models and AI to make trading decisions. Although its methods are closely guarded, it’s widely known that machine learning and massive data processing play central roles in its proprietary strategies.

2. Two Sigma and Citadel – Machine Learning at Scale

These hedge funds leverage AI to process petabytes of structured and unstructured data. From satellite images to shipping traffic and social media feeds, their algorithms seek patterns that can offer a competitive edge in market timing and asset allocation.

3. BloombergGPT & NLP Systems – Interpreting Financial Texts

In 2023, Bloomberg introduced BloombergGPT, a large language model trained specifically on financial texts. It can summarize earnings calls, analyze financial reports, and generate structured insights from unstructured language — all tasks that would take human analysts hours to complete.

4. Robo-Advisors (e.g., Wealthfront, Betterment)

These platforms use AI to automate portfolio construction and rebalancing. By assessing risk tolerance, income level, and financial goals, robo-advisors offer personalized investment plans without human intervention — often at a fraction of the cost of traditional advisors.

5. Sentiment Analysis Tools (e.g., Kavout, Accern)

AI-powered platforms scan news articles, Twitter, Reddit, and financial forums to extract market sentiment. This data is then transformed into actionable insights, such as bullish or bearish signals on specific stocks.

These examples highlight the versatility of AI across the finance industry — not only in high-frequency trading, but also in research, risk management, and personalized investment tools.

6.Can AI Really Beat the Market?

With AI’s impressive capabilities — lightning-fast data processing, pattern recognition, and adaptability — it’s natural to ask: Can AI actually outperform the market?

The answer, as with most things in finance, is nuanced.

In specific conditions, AI-driven systems can outperform traditional methods. High-frequency trading (HFT) firms, for instance, have long used AI to exploit microsecond-level price inefficiencies. Some quantitative hedge funds — such as Renaissance Technologies — have posted extraordinary returns, widely attributed to algorithmic and AI-enhanced strategies.

But beating the market consistently is another story.

📉 Market Efficiency and the AI Arms Race

The stock market is a complex, adaptive system. As more market participants adopt AI, alpha-generating opportunities diminish — a phenomenon known as alpha decay. In essence, the more people use AI to find hidden opportunities, the faster those opportunities disappear.

Moreover, public markets are relatively efficient. Price changes often reflect newly available information quickly, making it hard even for advanced models to gain lasting edge without exclusive data or infrastructure.

⚠️ Limitations of AI in Real-World Trading

- Overfitting: AI models trained on historical data may perform well in simulations but fail in live markets.

- Black-box Risk: Many models, especially deep learning ones, lack transparency — making it difficult to understand why they make specific predictions.

- Regime Shifts: Market conditions can change abruptly (e.g., pandemic, war, interest rate shocks), making historical data less reliable.

Ultimately, while AI offers powerful tools for analyzing and responding to market dynamics, it is not a crystal ball. Successful use depends on proper model design, data quality, and risk management — and even then, there are no guarantees.

7. What’s Next: The Future of AI in Investing

🌍 Reading the World Beyond the Data

AI models rely on data that is structured, labeled, or available in digital form. But global financial markets are deeply influenced by complex real-world developments — geopolitical tension, regulatory shifts, social movements, and even subtle diplomatic tone.

For example, when a government signals a possible trade war or a major central bank hints at a policy pivot, the implications may be nuanced and context-sensitive. An AI might pick up the headline, but fail to capture the tone, implications, or political subtext.

These are situations where human analysts excel. With a deeper understanding of history, culture, and unstructured real-time developments, humans can connect dots that machines may not even recognize.

Real-world examples include:

- The Russia–Ukraine war (2022–): AI models initially failed to assess the long-term impact of the invasion on energy markets, inflation, and global supply chains.

- The Israel–Hamas conflict (2023–): While headlines spread quickly, only human analysts could interpret the political consequences and potential global market ripple effects.

- OPEC’s unexpected production cuts: AI might detect the news, but human insight is needed to understand the strategic motives, geopolitical pressure, and implications for oil-dependent economies.

As Bloomberg analyst Sarah Ponczek once noted:

“Algorithms may be fast, but they don’t understand fear or diplomacy.”

8. What’s Next: The Future of AI in Investing

AI is still evolving — and so is its role in investing. As the technology becomes more advanced, accessible, and integrated, we’re likely to see a shift in how investors interact with markets.

One major trend is the democratization of AI tools. What was once reserved for elite hedge funds is now entering the hands of everyday investors. Platforms are emerging that offer AI-powered research assistants, stock screening tools, and portfolio optimizers — all with user-friendly interfaces.

Another growing area is natural language processing (NLP). As models like ChatGPT and BloombergGPT become better at understanding financial context, we’re approaching an era where AI can summarize earnings calls, decode central bank speeches, and even answer investor questions in real time.

In the near future, we may also see:

- Auto-adaptive trading bots that adjust to macroeconomic shocks automatically.

- Personal finance copilots powered by large language models, helping users build strategies aligned with their goals.

- Real-time sentiment dashboards showing how global news affects portfolio exposure.

However, as AI becomes more deeply embedded in investment decisions, transparency, accountability, and regulation will be increasingly important. Investors — especially retail ones — must remain cautious of over-relying on tools they don’t fully understand.

The bottom line? AI won’t replace humans. But humans who use AI effectively will likely outperform those who don’t.

📌 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Please consult a professional advisor before making any investment decisions.