Introduction: A Bold Return to Protectionism

On April 2, 2025, President Donald J. Trump unveiled one of the most aggressive trade policy moves of his second term—a sweeping set of tariffs targeting a wide range of U.S. trading partners. Dubbed the “Reciprocal Tariff Plan,” this initiative is designed to mirror the average tariff levels that each country imposes on American exports.

The plan imposes a minimum 10% tariff on all imported goods, with significantly higher rates applied to countries that levy substantial duties on U.S. products. While the White House argues that this is a step toward trade fairness, economists and market analysts warn that the implications could be severe.

Details of the Reciprocal Tariff System

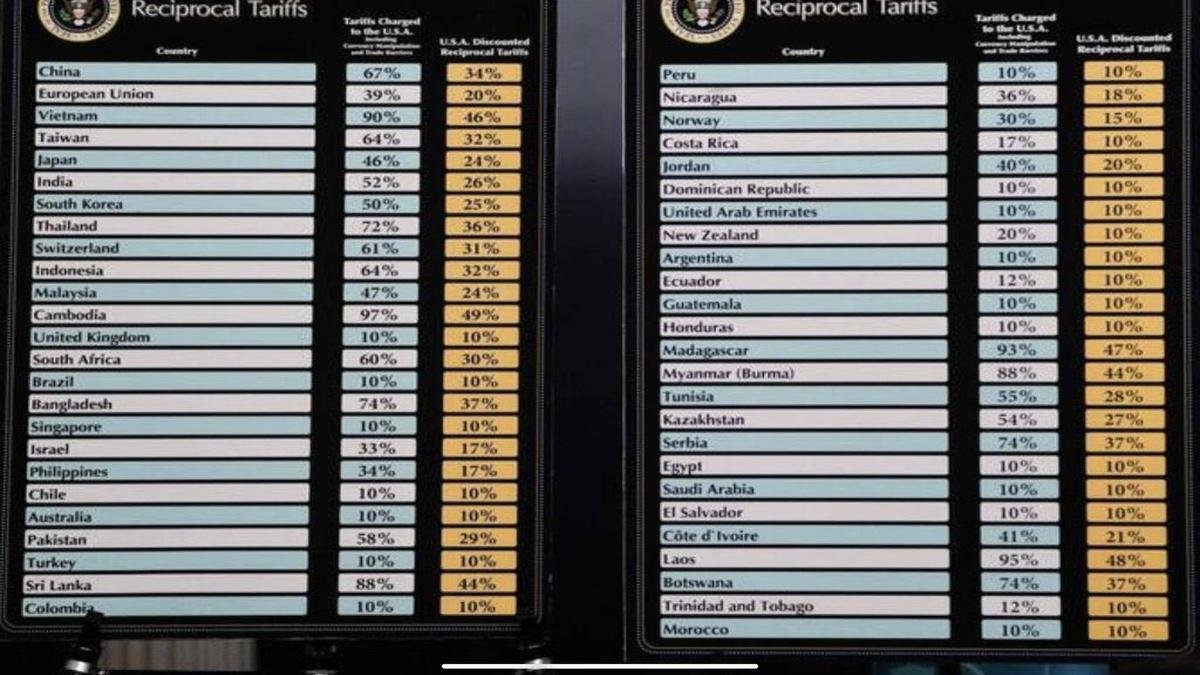

Under the new policy, each country’s tariffs on U.S. goods were analyzed and matched by the Trump administration with an equal or “discounted reciprocal” tariff. Some of the most impacted countries include:

- China: 67% average tariff on U.S. goods → 34% reciprocal tariff imposed by U.S.

- Vietnam: 90% → 46%

- India: 52% → 26%

- South Korea: 50% → 25%

- Bangladesh: 74% → 37%

Meanwhile, allies like the UK, Canada, and Japan—despite maintaining relatively lower tariffs—still face baseline tariffs, with U.S. automobile imports now taxed at 25% across the board, impacting countries like Germany, Japan, and South Korea in particular.

Market Reactions and Investor Sentiment

The financial markets responded swiftly to the announcement. On April 3, 2025:

- The Dow Jones Industrial Average fell over 950 points (-2.8%)

- The NASDAQ Composite dropped 3.2%, heavily impacted by multinational tech stocks

- The VIX Index, a volatility measure, surged past 27

Investors are bracing for higher inflation, supply chain disruptions, and reduced corporate margins. According to an AP News analysis, economists estimate that tariffs could raise consumer costs by 2.3% annually, costing each American household an average of $3,800.

Industry Impact: Winners and Losers

Winners:

- Domestic steel, aluminum, and manufacturing: Companies like U.S. Steel and Nucor are expected to benefit from reduced foreign competition.

- Defense contractors: With increased military procurement and incentives for U.S.-sourced components, firms such as Lockheed Martin may gain.

Losers:

- Automotive sector: Foreign automakers like Toyota and BMW, and even U.S. firms relying on overseas parts, face major cost increases.

- Retail and consumer electronics: Walmart, Best Buy, and Apple may be forced to raise prices.

Global Backlash and Retaliation

The international response has been swift:

- China announced it would implement retaliatory tariffs of up to 34% on U.S. agricultural goods and rare earth materials. (Politico)

- European Union has filed a complaint at the World Trade Organization and plans to tax U.S. tech companies via carbon and digital levies. (Bloomberg)

- Mexico and Canada, key USMCA partners, have pledged “measured, reciprocal tariffs” to defend their industries. (Bloomberg)

“This is not how partners treat one another,” said EU Trade Commissioner Ursula Weber. “We will respond firmly if dialogue fails.”

Political Fallout and Legislative Pushback

The tariffs have sparked fierce debate in Washington. Several Republican senators from agricultural states have voiced concern that retaliatory tariffs could devastate farmers already dealing with tight margins.

Democrats have introduced legislation requiring congressional approval for major tariff changes, citing constitutional concerns over executive trade powers.

Meanwhile, Trump defended his decision via Truth Social, writing:

“Tariffs are the greatest tool we have. The fake media won’t tell you that, but America is winning again!”

Strategic and Long-Term Implications

Inflation & Recession Risks

Economists warn that if tariffs persist, they could add to existing inflationary pressure and delay Federal Reserve rate cuts. Consumer spending may fall as imported goods rise in price.

Supply Chain Shifts

Some U.S. firms may consider reshoring production, but others may simply shift from China to Vietnam, India, or Mexico—countries also facing rising tariffs.

Diplomatic Relations

Allies such as Japan, South Korea, and Taiwan have expressed disappointment, signaling a shift in trust and economic cooperation.

“This makes trans-Pacific coordination even harder,” said economist Ellen Wu at the Peterson Institute.

Economic Forecast: Short-Term Pain, Uncertain Gains

| Metric | Projected Impact by Q4 2025 |

|---|---|

| U.S. GDP | ↓ by 0.7% |

| Consumer Prices (CPI) | ↑ by 2.3% |

| Average Household Cost | ↑ $3,800/year |

| Unemployment Rate | ↑ by 0.4% (mainly in retail/logistics) |

| Manufacturing Output | ↑ slightly (+0.5%) |

Conclusion: Protection or Provocation?

Trump’s reciprocal tariff plan is a bold return to economic nationalism. Supporters hail it as a way to balance unfair global trade; critics see it as a blunt instrument that risks economic harm, both at home and abroad.

The coming months will be a true test of Trump’s trade doctrine. Investors, businesses, and global partners will be watching closely.

As markets reel and trade partners prepare retaliation, one thing is clear: the world’s largest economy has reignited a global debate over tariffs, sovereignty, and economic leverage.

Sources Embedded:

- Trump Boasts Sweeping Tariffs Will Make U.S. Stronger – NYPost

- Politico: Trump Says Tariff Policies Will Never Change

- AP News: What to Know About the Trump Tariffs

- TIME: Trump’s Tariffs Face Resistance in Congress

- Business Insider: Companies Raising Prices Due to Tariffs

- Bloomberg: U.S. Allies Respond to Tariff Threats

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a qualified professional before making investment decisions.