Impact-Site-Verification: undefined

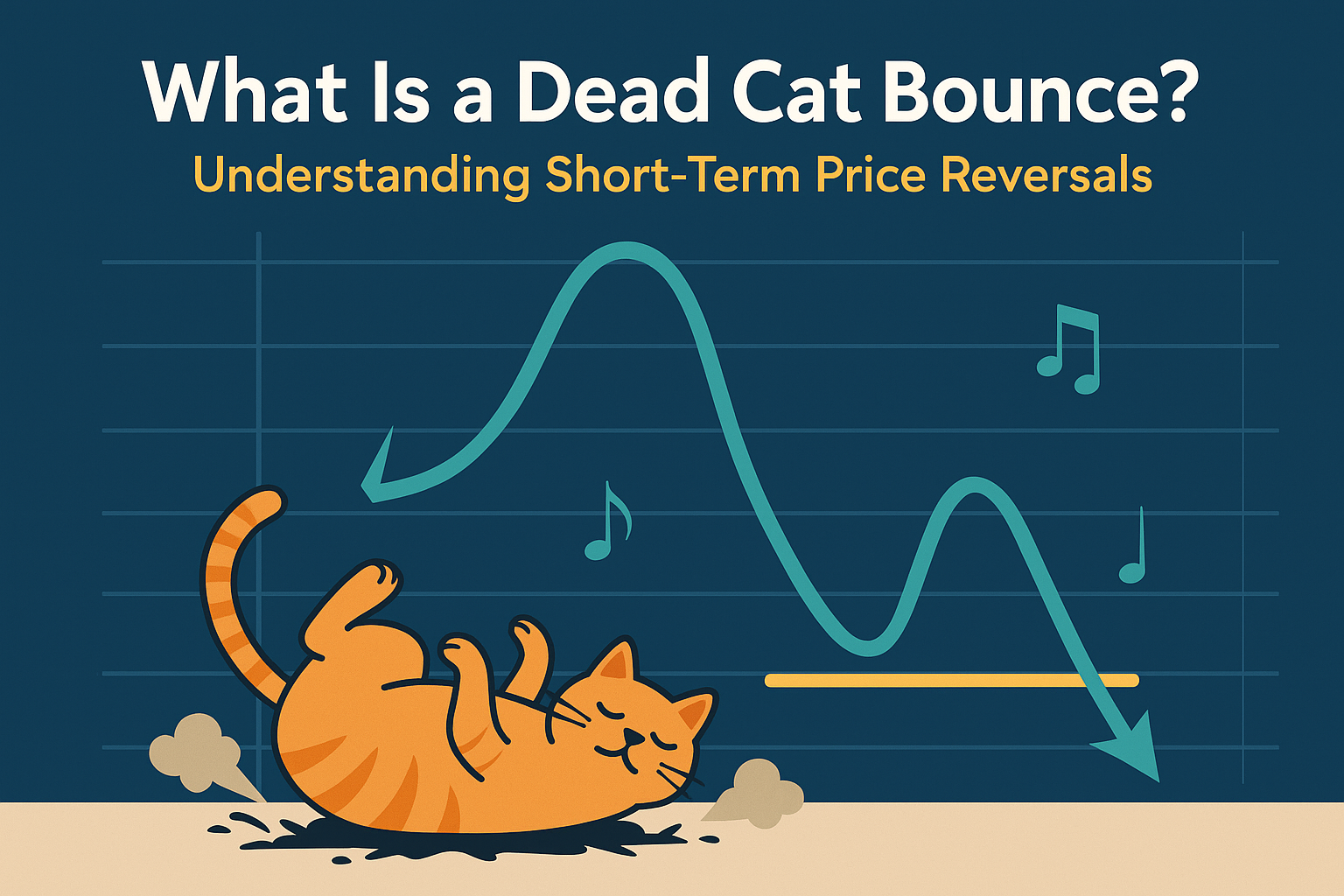

Explore the concept of a dead cat bounce, a short-term price reversal that occurs during a downtrend in the stock market. Learn to identify this technical analysis pattern and understand its implications for investors. This article is for informational purposes only and does not constitute financial advice.

Understanding the Dead Cat Bounce: A Fleeting Market Rally

In the world of stock market investing, where fortunes can be made and lost with dizzying speed, it’s crucial to understand the various patterns and phenomena that can influence price movements. One such phenomenon, known as a “dead cat bounce,” can be particularly deceptive for investors. This essay aims to provide a comprehensive explanation of what a dead cat bounce is, how to identify it, and what it signifies within the broader context of market trends.

Defining the Dead Cat Bounce

A dead cat bounce (DCB) is a technical analysis pattern that describes a brief, temporary recovery in the price of a stock or other asset during a larger, ongoing downtrend. The name itself is rather morbid, suggesting that even a dead cat will bounce if it falls from a great height. In market terms, it implies that even in a severe and persistent decline, there will be brief periods where the price rebounds. However, this rebound is ultimately unsustainable, and the price eventually resumes its downward trajectory.

To understand this concept fully, let’s break down the key elements:

- Downtrend: A downtrend is a period where the price of an asset is generally moving lower over time. This is characterized by lower highs and lower lows.

- Temporary Recovery: Within this downtrend, there is a short period where the price moves higher. This recovery might last for a few days or a few weeks.

- Unsustainable Rebound: The price increase during the recovery is not supported by strong fundamentals or a genuine change in market sentiment. It’s often driven by short covering (traders who had bet against the asset buying it back to limit their losses) or bargain hunting by investors hoping to “buy the dip.”

- Resumption of Downtrend: After the temporary recovery, the forces driving the downtrend reassert themselves, and the price continues to move lower, often reaching new lows.

In essence, a dead cat bounce is a false signal that can mislead investors into believing that a declining asset is recovering.

Characteristics of a Dead Cat Bounce

While every market is unique, there are some common characteristics that can help identify a potential dead cat bounce:

- Sharp Downtrend Preceding the Bounce: A DCB typically occurs after a significant and rapid decline in the price of an asset. This decline creates oversold conditions, where the price has fallen so quickly that it is considered undervalued in the short term.

- Low Volume on the Rebound: The volume of trading during the price increase is often lower than average. This suggests that the rally is not driven by strong buying interest or conviction.

- Short Duration: The recovery is relatively short-lived compared to the preceding downtrend. It might last for a few days or a few weeks, but it does not represent a long-term change in trend.

- Failure to Reach Previous Highs: The price fails to reach its previous high point before the downtrend began. This indicates a lack of strong buying pressure.

- Resumption of Downtrend with Increased Volume: After the temporary recovery, the price starts to decline again, often with increased trading volume. This confirms that the underlying selling pressure remains strong.

- Technical Indicators: Technical indicators, such as the Relative Strength Index (RSI), might show a brief improvement during the bounce, moving from oversold levels. However, these indicators quickly reverse as the downtrend resumes.

What Causes a Dead Cat Bounce?

Several factors can contribute to the formation of a dead cat bounce:

- Short Covering: Traders who have taken short positions (betting that the price of an asset will decline) may buy back the asset to cover their positions and lock in their profits. This buying activity can temporarily push the price higher.

- Bargain Hunting: Some investors may see the sharp decline as an opportunity to buy the asset at a “discount.” This buying pressure can also contribute to the temporary price increase. However, these bargain hunters may not fully appreciate the underlying reasons for the downtrend.

- Market Psychology: After a prolonged decline, some investors may become hopeful for a reversal, leading to a brief period of optimism and buying. This can create a self-fulfilling prophecy in the short term, pushing the price higher.

- Lack of Sellers: In a very steep decline, the number of sellers may temporarily decrease as those who wanted to sell have already done so. This temporary absence of selling pressure can allow the price to rebound slightly.

- Technical Factors: The price rebound may be influenced by technical factors, such as the asset reaching a support level. However, if the underlying downtrend is strong, this support level will eventually be broken.

Identifying a Dead Cat Bounce

Identifying a dead cat bounce in real-time can be challenging, as it often appears to be a genuine reversal at first. However, by carefully analyzing price action, volume, and technical indicators, investors can increase their chances of recognizing this pattern:

- Confirm the Downtrend: Ensure that the asset has been in a clear downtrend before the suspected bounce. Look for lower highs and lower lows over a significant period.

- Analyze the Volume: Pay close attention to the trading volume during the price increase. Low volume suggests a weak rally and a higher probability of a DCB.

- Check the Duration: Consider the length of the price increase. A DCB is typically short-lived compared to the preceding downtrend.

- Monitor Technical Indicators: Use indicators like the RSI, MACD, and moving averages to assess the strength of the rally. A failure to reach overbought levels or a quick reversal of these indicators can signal a DCB.

- Look for Resistance Levels: Identify key resistance levels that the price fails to break through during the rebound. These levels can act as a ceiling, preventing further price increases.

- Observe the Price Action: Watch for signs of weakness in the price action, such as small-bodied candles, long upper shadows, or a failure to sustain upward momentum.

- Wait for Confirmation: It’s often best to wait for confirmation of the resumption of the downtrend before concluding that a DCB has occurred. This confirmation can come in the form of a break below a key support level or a significant increase in selling volume.

Implications of a Dead Cat Bounce

The dead cat bounce has several important implications for investors:

- False Hope: A DCB can give investors false hope that a declining asset is recovering, leading them to buy or hold onto the asset when they should be selling.

- Missed Opportunities: Investors who are fooled by a DCB may miss the opportunity to sell the asset at a higher price before the downtrend resumes.

- Increased Losses: Buying into a DCB can lead to significant losses as the price continues to decline, potentially reaching new lows.

- Emotional Distress: Experiencing losses due to a DCB can be emotionally distressing for investors, leading to poor decision-making in the future.

- Market Inefficiency: A DCB can create temporary market inefficiency, where the price of an asset is temporarily disconnected from its fundamental value.

- Increased Volatility: The period following a DCB can be particularly volatile as the market adjusts to the resumption of the downtrend.

Examples of Dead Cat Bounces

Dead cat bounces can occur in various markets, including stocks, bonds, commodities, and even cryptocurrencies. Here are a few notable examples:

- The 2000s Tech Bubble Burst: After the dot-com bubble burst in the early 2000s, many tech stocks experienced significant declines. There were several dead cat bounces along the way, where investors briefly believed that the worst was over, only to see prices fall further.

- The 2008 Financial Crisis: During the 2008 financial crisis, the stock market experienced a series of sharp declines and brief rallies. Many of these rallies turned out to be dead cat bounces, as the market continued its downward spiral.

- Individual Stock Crashes: Dead cat bounces can also occur in individual stocks that experience a sudden and severe decline due to bad news, earnings misses, or other negative catalysts.

Trading Strategies and Dead Cat Bounces

While a dead cat bounce can be a trap for investors, some traders attempt to profit from it. However, these strategies are highly risky and require a deep understanding of technical analysis and market dynamics:

- Fading the Bounce: This strategy involves taking a short position (betting on a price decline) during the dead cat bounce, anticipating that the downtrend will resume. This requires accurately identifying the DCB and having a strong risk management plan.

- Buying the Initial Decline, Selling the Bounce: Some traders try to buy the asset during the initial sharp decline, aiming to sell it during the dead cat bounce for a quick profit. This strategy is also very risky, as it relies on timing the market accurately.

Disclaimer: These trading strategies are highly speculative and involve a significant risk of loss. They are not suitable for all investors. This article is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions.

Dead Cat Bounce vs. Genuine Reversal

It’s crucial to distinguish between a dead cat bounce and a genuine reversal, where the downtrend actually ends and a new uptrend begins. Here are some key differences:

| Feature | Dead Cat Bounce | Genuine Reversal |

|---|---|---|

| Preceding Trend | Sharp Downtrend | Downtrend (can be less severe) |

| Volume | Low volume during the rally | High volume during the rally |

| Duration | Short-lived | Longer duration |

| Retracement | Fails to reach previous highs | Retraces a significant portion of the downtrend |

| Technicals | Weak indicators, quick reversal | Strong indicators, sustained momentum |

| Fundamental Change | No significant change in underlying fundamentals | Positive change in underlying fundamentals |

| Price Action | Weak price action, resumption of downtrend | Strong price action, establishment of higher highs |

Conclusion

The dead cat bounce is a deceptive pattern that can trap unwary investors. By understanding its characteristics, causes, and implications, investors can improve their ability to identify this phenomenon and avoid making costly mistakes. Recognizing the difference between a dead cat bounce and a genuine reversal is crucial for making informed investment decisions and protecting your portfolio in volatile market conditions. Remember, a healthy dose of skepticism and a reliance on sound analysis are essential tools for navigating the complexities of the stock market.

This article is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions.

The concept of a dead cat bounce is both fascinating and cautionary for investors. It’s intriguing how even in a severe downtrend, there’s always a glimmer of hope that can mislead so many. However, it’s also a reminder of how dangerous it can be to act on surface-level signals without deeper analysis. I think this pattern highlights the importance of patience and thorough research in investing. But how do you differentiate a dead cat bounce from an actual trend reversal in real-time? It seems like even experienced traders could easily get caught in this trap. Do you believe there’s a foolproof method to identify it, or is it always a gamble? I’d love to hear your thoughts or experiences with this phenomenon—have you ever been caught off guard by a dead cat bounce? What lessons did you learn from it?

The concept of a dead cat bounce is fascinating, especially for someone trying to navigate the unpredictable waters of the stock market. It’s intriguing how such a brief recovery can mislead so many investors into thinking a downtrend is reversing. I wonder, though, how often this pattern actually plays out as expected—are there cases where the bounce leads to a genuine recovery? The article mentions analyzing price action and volume, but I’m curious if there are specific indicators or tools that are particularly reliable for spotting this pattern. Also, how do seasoned investors differentiate between a dead cat bounce and the start of a real uptrend? It feels like this pattern could easily trap even the most cautious traders. What’s your take on the psychological aspect of this—do you think fear and hope play a bigger role in misjudging these situations? Would love to hear your thoughts or experiences with this!

The concept of a dead cat bounce is fascinating, especially for those navigating the volatile world of stock markets. It’s intriguing how such a brief and deceptive recovery can mislead even seasoned investors. I wonder, though, how often this pattern actually leads to significant losses for those who misinterpret it. The analogy of a dead cat bouncing is both vivid and a bit unsettling, but it effectively drives the point home. Do you think there are specific industries or sectors where this phenomenon is more prevalent? Also, how reliable are technical indicators in predicting a dead cat bounce versus a genuine recovery? It’s a reminder of how crucial it is to stay vigilant and not get swayed by short-term movements. What’s your take on balancing technical analysis with broader market trends to avoid such pitfalls?

The concept of a dead cat bounce is fascinating, especially for those navigating the unpredictable waters of the stock market. It’s intriguing how such a brief and deceptive recovery can mislead even seasoned investors. I wonder, though, how often this pattern actually occurs in real-world trading scenarios? It seems like identifying it in real-time requires a sharp eye and a deep understanding of market trends. Do you think relying solely on technical indicators is enough, or should investors also consider broader market sentiment? Personally, I find the name itself quite grim, but it does drive home the point about the temporary nature of such recoveries. What’s your take on the psychological impact of a dead cat bounce on investors? Could it lead to panic selling or overconfidence? Lastly, do you believe this pattern is more common in certain types of markets or sectors? I’d love to hear your thoughts!

The concept of a dead cat bounce is fascinating yet somewhat unsettling, especially for new investors trying to navigate the stock market. It highlights how deceptive price movements can be, even for seasoned traders. Understanding this pattern seems crucial to avoid making hasty decisions during downtrends. However, I wonder how often investors actually fall for this trap and how much it impacts their portfolios. Could there be specific industries or types of stocks more prone to dead cat bounces? Personally, I find the metaphor both vivid and grim—do you think it effectively conveys the risk, or is it unnecessarily dramatic? How do you typically differentiate between a genuine recovery and a dead cat bounce in your analysis?

The concept of a dead cat bounce is both fascinating and a bit alarming. It’s intriguing how markets can deceive even seasoned investors with these temporary recoveries. I wonder if there are specific industries or sectors where this phenomenon is more common? Also, how do you differentiate a dead cat bounce from a genuine trend reversal, especially when the initial signs look so similar? The name itself is morbid, but it does drive home the idea that not all rebounds are sustainable. Do you think this pattern is more prevalent during certain economic conditions? Lastly, I’m curious, what strategies do you use to avoid falling into the trap of a dead cat bounce? It seems like a tricky pattern to navigate, and I’d love to hear more about your approach to this. Can you share any real-life examples or insights?

Interesting read on the dead cat bounce—definitely a concept that can catch investors off guard if they’re not careful. I’ve often wondered how much of this pattern is psychological versus purely technical. Do you think traders’ emotions play a bigger role in creating these temporary rebounds than the market fundamentals? Also, how reliable are the indicators in spotting a dead cat bounce before it’s too late? I’d argue that while technical analysis is useful, it’s easy to get trapped in hindsight bias. What’s your take on balancing technical signals with broader market context? Finally, do you think the term “dead cat bounce” itself influences how traders perceive these patterns, or is it just a catchy label? Would love to hear your thoughts!